Why Did Finance Transformation Fail Four Times?

Why?

If your team, department or company are about to embark on some kind of transformation OR have already embarked on one and it's progress is stalling, then it's highly likely your organisation has a skills deficit in the form of Strategic Thinking. This will manifest similar to an Ant Mill Death Spiral, a phrase first coined by William Beebe in 1921 to describe a continuously rotating circle of Army Ants, having lost their pheromone trail, mindlessly repeating their vicious cycle until they die of exhaustion. Believe it or not, leaders in business also succumb to this phenomenon, and more often than you'd think.

What?

To better understand why this skill is so rare, especially in a business context, we will cover what Strategic Thinking actually is, the Top 3 reasons it tends to be underdeveloped or absent in a business context and why this deficit is significant for any kind of organisational transformation.

How?

We will deconstruct a real-world scenario from one of my projects in the form of a Finance Transformation in a large enterprise that failed four times in two years before being successful on the fifth attempt. As part of our analysis we will answer these 3 questions:

What is Strategic Thinking? Revealing correlation between problems and their solutions.

What roles do Recruitment & Culture play? Revealing the causes of a Strategic Thinking deficit.

What role does intelligence play? Revealing the correlation between IQ and problem complexity.

Strategic Thinking

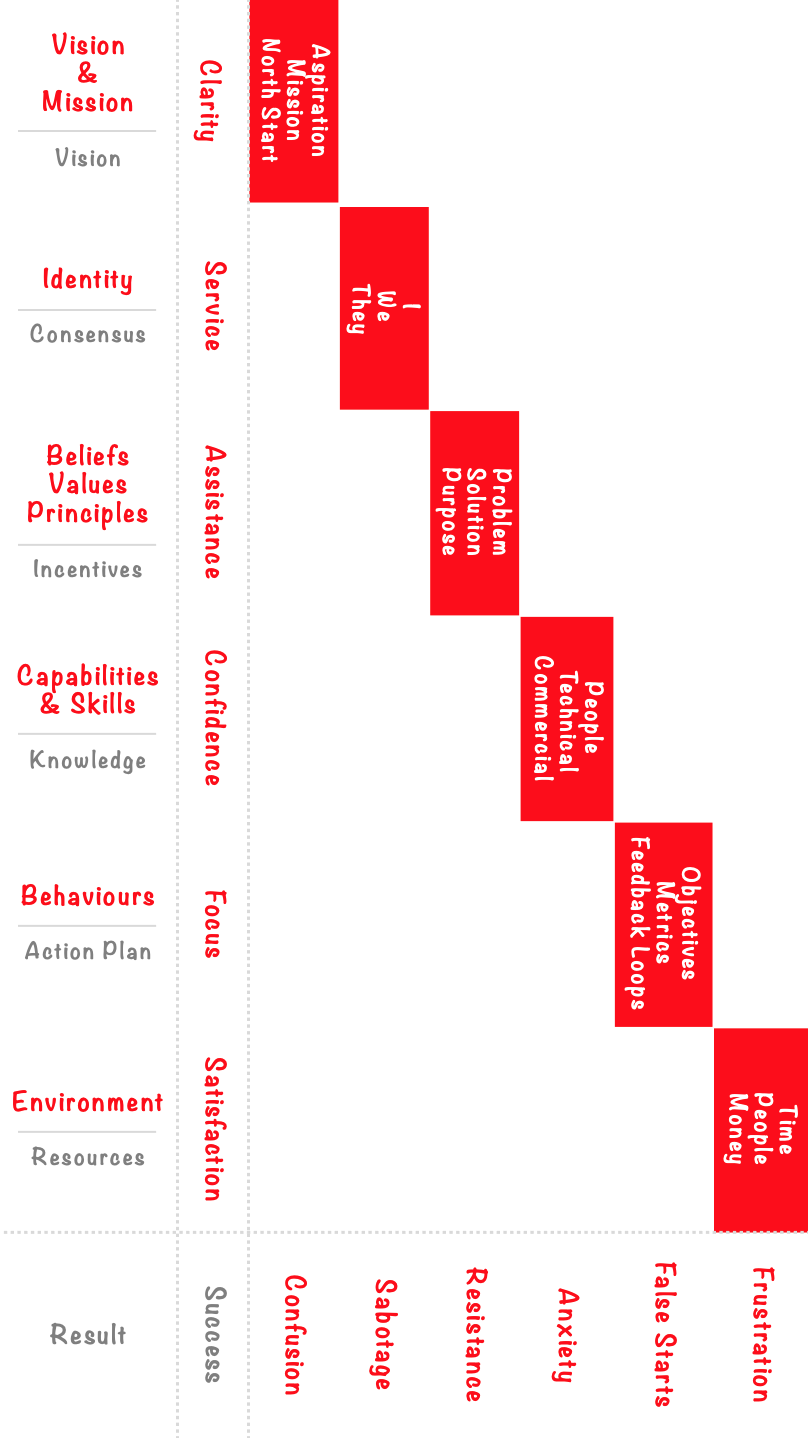

I created this model based on the work of Tim Knoster, Dr of Education and Professor of Exceptionality Programs at Bloomsberg University of Pennsylvania. His research in developmental learning unveiled the correlation between the components of strategy and human fallout, which ultimately determines the level of success or failure in any endeavour. My version is an adaptation of the original for use in a business context by any individual, team or organisation in pursuit of a specific outcome. This can be anything from delivering a career defining presentation to leading an organisational transformation in a large enterprise. In the context of this case study we will use it to deconstruct our Finance Transformation.

As you can see each level of strategy correlates with some form of human fallout when a level is missing or populated incorrectly.

Confusion: People pulling in different directions, circuitous conversations & head scratching.

Sabotage: Deliberately or unintentionally undermining your own or each others efforts.

Resistance: Covert or overt opposition to suggested or required courses of action.

Anxiety: Unable to figure out how to manage a particular person, problem or task.

False Starts: Frequently jumping from task to task, unsure of priorities, completing some, if any.

Frustration: Inability to move anything forward regardless of how much effort is employed.

The keystone skill that must be present to leverage this tool is Strategic Thinking. This skill is required to identify the root cause of a problem, intimately understand the problem, define a solution and create a roadmap to successfully transition from problem state to solution state. In other words: Where are we, where do we want to be and how do we get there?

In more complex problem solving cases this skill must be present to make connections in, in what most would consider, disparate data, i.e. Information that seems to be unrelated. This is why most leaders end up unknowingly papering over the symptoms instead of fixing problem. Their analysis wasn't thorough enough and they didn't know it. The Irony is this skill is also the same skill that’s required to recognise there is a problem in the first place.

Strategic Thinking is also a keystone influencing skill as it must be present for someone to work through uncovering another's motivation, and therefore incentives to define mutually beneficial outcomes that will drive participation and collaboration when needed. I think there are 3 key reasons why this skill is underdeveloped, if not absent, in any organisation:

Recruitment: Strategic thinkers are creative, therefore disruptive and recruiting briefs typically seek cookie cutters.

Culture: As an organisation grows Strategic thinking is, accidentally or deliberately, discouraged in favour of compliance.

Intelligence: The ability to solve complex problems correlates with IQ, the more complex the higher the IQ required.

These factors form an invisible funnel that filter Strategic Thinkers out of an organisation and suppress most of those that manage to slip through the selection process. Those that do will likely leave to find an environment that allows them to leverage their skill. This results in very few with the required level of creativity and intelligence making it to the top, perpetuating the vicious Ant Mill cycle, something Jordan Peterson, Professor of Psychology at the University of Toronto, highlights in his work.

With advances in technology resulting in high quality data capture, that businesses are implementing at an increasing rate, our working environments are increasingly algorithmic, relying on strategic partnerships, trustworthy relationships and decentralised decision making to collaboratively leverage this data to deliver meaningful outcomes. These systems and the data they produce are useless without this keystone skill.

This brings us neatly to our example. I was asked to support a Finance Director with their Finance transformation in a large enterprise, which included 240 people. Four Finance Directors had been recruited to lead this transformation in the two years previous. All failed in their attempts to cross the finish line. Each compounded the issues by repeating the same decision making cycle as their predecessor. A fundamental lack of strategic thinking resulted in a cycle of soaring overheads, increasing headcount and ever decreasing efficiency and effectiveness.

The newly appointed fifth FD was on the verge of doing exactly the same as the skillsets of their current senior leadership team had peaked. Instead of developing efficient ways of working they dug themselves into a hole by repeatedly hiring more and more cookie cutter finance people under the guise of: If we just work harder. The new FD wanted to hire a couple of senior interim finance specialists to solve the problem until I pointed out a headcount of 200+ finance people simultaneously failing to execute their duties was far from coincidence. There was a significant systemic organisational issue afoot.

What did all this tell us about the culture we were walking in to?

Recruitment & Culture

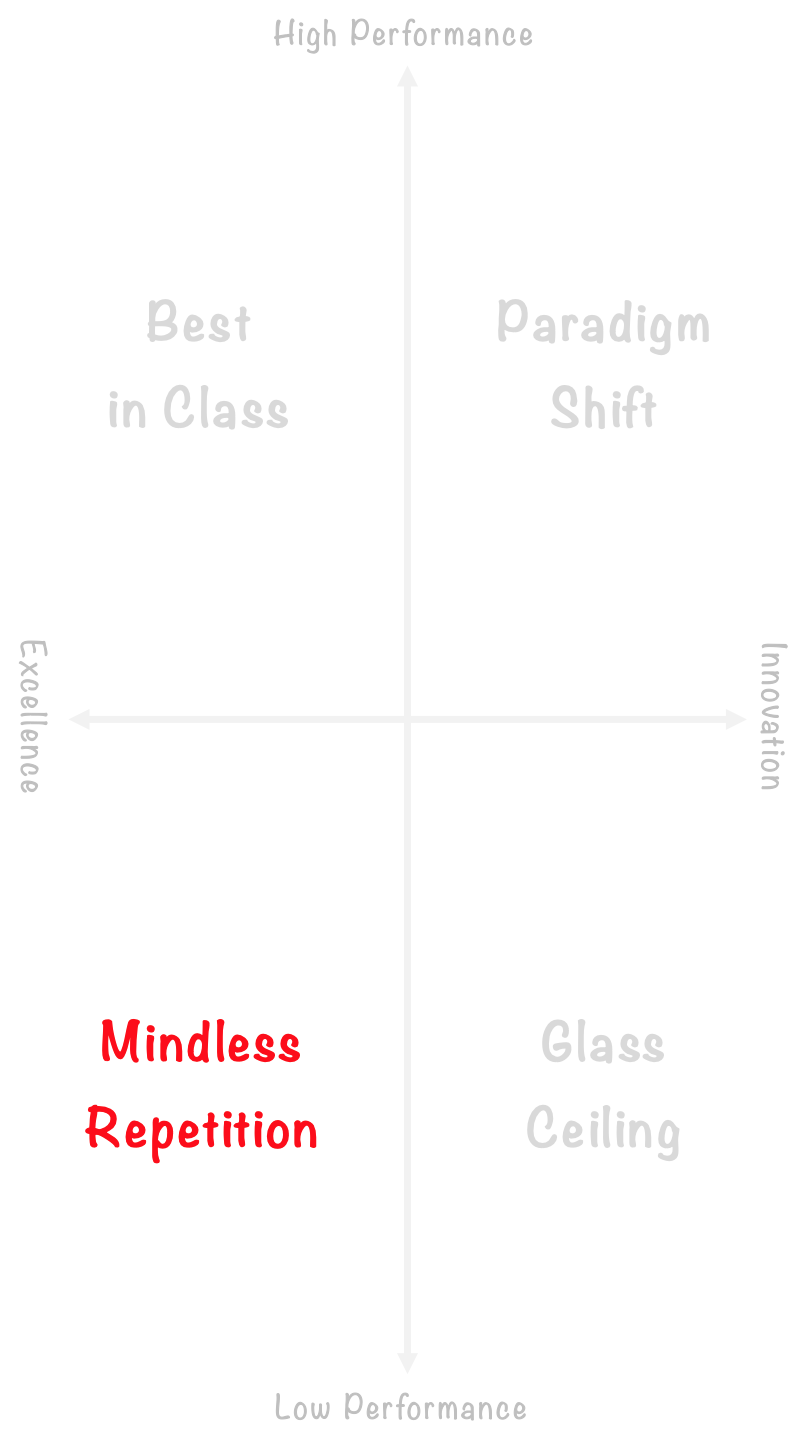

The model below is based on a decision matrix the US Navy SEALs use for leadership selection. For the purpose of this article I have swapped Low Trust for Excellence, defined as: The quality of being outstanding or extremely good, and High Trust with Innovation, defined as: Not previously thought of ways of thinking, ideas or products. We can then demonstrate their relationship with Performance, defined as: A demonstration of technical skills. Four organisational cultures emerge to offer a sense of who might manifest in each area:

These four cultures correlate with specific behaviours that can be measured in any individual, team or organisation:

Best in Class: Purposeful practice that yields measurable incremental gains regardless of org size.

Mindless Repetition: Doing the same thing over and over expecting a different result, insanity.

Glass Ceiling: Unacknowledged barrier to advance good ideas with a high failure rate.

Paradigm Shift: Permanent measurable change that creates a never before market, product or outcome.

Recruiters, internal or external, are typically briefed to source technical skills for a particular industry or sector. This creates a very narrow window from which to view the world. It also ensures any hires will have read the same books and completed the same courses and certifications as those choosing to hire.

The effect is a steady stream of people that all typically think the same way about the same things as those that hired them. Ideal when compliance is required, but useless when creativity is required. With the exception of the very few that get passed the recruiter there is a distinct absence in individual, team or organisational ability to approach any problem from a different perspective. Group think and a bubble of confirmation bias ensue. Unsurprisingly this is one of the reasons why, as organisations grow in headcount, competence measurably increases linearly and incompetence measurably increases exponentially. To learn more about this do read: How Much Does Incompetence Cost Your Business?

In the context of our example; The organisation had attempted to execute a transformation in pursuit of excellence and failed 4 times. They recruited more and more of the same people with the same qualifications and the same skill set resulting in a view too narrow to solve what they thought were finance problems. The lack of Strategic Thinking meant they never figured out they had people problems that symptomatically manifested in a finance context. At no time did it ever occur to anyone to look through a different lens for a different perspective after implementing the same "solutions" time and time again that clearly didn't work. It’s fair to say there was a culture of mindless repetition. The analogy of the ant mill death spiral will now be coming to life as they lost the pheromone trail and proceeded to go round in circles until each FD could do no more. I have no idea if they were fired or resigned as this happened before my time.

Unlike the newly appointed finance director their predecessors were very much command and control orientated providing instructional inputs: Do this do that, do it like this, do it like that. The cascade of this behaviour encouraged the entire population of 240+ people to develop learned helplessness, including the FD's direct reports. They had also crushed all and any kind of proactive participation, decision making and good will by everyone below senior level.

With all this in mind, where does intelligence fit in relation to Strategic Thinking?

Intelligence

Below is the IQ scale, or Intelligence Quotient Scale, based on the original work of two Psychologists Alfred Binet and Theodore Simon, later updated by Dr Lewis Terman a Psychologist at Stanford University. A brief explanation of what IQ measures is: A persons ability to process information in terms of volume and complexity in any given moment across different domains, such as; linguistic, spatial, numerical and so on. The greater the volume and complexity of information a person can process the greater their IQ score.

You can see the model demonstrates the distribution of IQ across the population and below is a list of IQ classifications and associated definitions:

40 - 54 Moderately impaired or delayed

55 - 69 Mildly impaired or delayed

70 - 79 Borderline impaired or delayed

80 - 89 Low average intelligence

90 - 109 Average / Normal

110 - 119 High average intelligence

120 - 129 Superior intelligence

130 - 144 Gifted or very advanced

145 - 160 Very gifted or highly advanced

IQ correlates with strategic thinking in terms of the scale and complexity of the problem to be defined and the ability to mentally hold on to a high volume of seemingly disparate data, and join the dots required to solve the problem in search of a meaningful solution.

To go back to our example: Accountants typically come in around 115-120. To keep things simple this gives us a credible base line for the 200+ people involved. The nature of the work would filter out anyone much below this line as they would not have the cognitive ability to complete the required manipulation of data and tasks associated with their roles, so we know they are capable people. Even so, resolving their organisational transformation problems were most likely beyond their cognitive reach as IQ also implies an upper limit for managing complexity. That said the distribution curve also demonstrates there will always be a super smart few that can operate above this range hiding in the ranks.

If we combine this with the fact they all more or less had the same training and certification in terms of technical skills, leading to an incredibly narrow view of the problem, and include the sheer number of moving parts they continued to introduce to their system, meaning their system had become far too complex for anyone to mentally hold on to, analyse and lead a collective effort to transform. It’s fair to say the organisation was never going to overcome their barriers to success without employing a radically different perspective and way of working.

Over the course of a year, through a hearts and minds campaign, we quickly got passed the internal politics and damage done by the previous leadership teams and found the very few strategic thinkers hiding in the ranks. On arrival we had been warned who the troublemakers and good guys were. Interestingly and unsurprisingly, the troublemakers were the strategic thinkers and the good guys turned out to be people who actively avoided challenge and conflict. This was immediately reversed.

Once all our cards were on the table we implemented a development program that would encourage our strategic thinkers to develop as leaders. As part of this we created in-house task forces to re-engineer the many broken processes, haemorrhaging £millions in lost or unclaimed revenue for years, from end to end by the people who used the processes daily. This created scenarios where those ready for leadership roles became self-evident.

As a result of creating a culture of decentralised decision making and autonomy we flipped the official annual HR employee engagement stats from 15% to 85% while generating a 50% saving in run-rate (£5million) in the same year. Many of those I supported now lead projects at national level and/or hold senior leadership roles in other organisations.

Conclusion

So What?

Strategic Thinking is a keystone problem solving skill, regardless of your role and the problems you are attempting to solve. This becomes ever more significant the further up an organisational hierarchy you go as the problems you will face become ever more abstract and complex. With this in mind, typical hiring practices filter this skill out of organisations in favour of cookie cutter clones and compliance, meaning this already rare skill becomes even more elusive, as demonstrated in our Finance Transformation example.

The price an organisation pays for the lack of Strategic Thinking, especially when attempting an Organisational Transformation, is a high likelihood of functioning like an Ant Mill, repeating the same costly decision cycles and mistakes until the organisational either collapses OR someone realises their actual problem is the need for a different perspective and skillset that can dig them out the hole they created, which our newly appointed FD did.

IQ is a key factor in the ability to Think Strategically as it correlates with the complexity and scale of problems any one person can solve. Everyone has an intellectual ceiling, and the higher the ceiling the rarer it is, which means the more complex a problem becomes the fewer the number of people that can solve it. The four previous FD's had clearly hit their ceiling when attempting to deliver the Finance Transformation, but the 5th FD demonstrably didn't.

Now what?

You cannot solve a problem if don’t recognise the problem. When a problem is beyond someone's cognitive reach it doesn’t matter how hard they work to solve it. They do not posses the capacity to deconstruct the problem to a level that allows them fully understand what needs to be done. As much as we investigated this in the context of a Finance Transformation, this will apply to any organisational transformation; Digital, HR, marketplace pivot, scale-up, etc.

The value of an objective outsider bringing a different lens and highly developed ability to think strategically is vastly under estimated, evidenced by the demonstrable outcomes produced in one year. The irony is that to recognise this also requires Strategic Thinking. It doesn’t have to be developed enough to solve the problem, but it does have to be developed enough to recognise there is a problem, and that you cannot solve it without external support, which our 5th FD did.

My favourite quote from Albert Einstein sums this up best: "The world we created is a product of our thinking. It cannot be changed without changing our thinking. No problem can be solved with the same level of consciousness that created it". Many leaders and consequently their organisations have and will inevitably to succumb to the fate of a narrow lens.

What next?

Now that you have a better understanding of why this Finance Transformation failed four times and successful on the fifth attempt, lets consider how you might use what you have learned:

Are you, your team, department or overall organisation about to embarked on, or already embarked on an Organisational Transformation of some kind? If so, from a leadership perspective, what considerations are you now aware of that you hadn't previously thought of?

Given the demonstrable need to ensure Strategic Thinking is on point for your transformation endeavour; What steps will you, your team, middle and senior leaders take to establish this as fact?

With the mathematically certain impact your Leadership IQ will have on your Organisational Transformation and it's likelihood of failure; What will you do mitigate the associated risks of leading your people through the transformation process?

Take your learning one step further and complete my Case Study Review. Capture your learning from this case study and commit to changes you deem relevant for your situation. A copy of your completed review will be emailed to you instantly.

If you wish to understand more about this social phenomenon then please do read: Why Do 70% of Digital Transformations Fail? which investigates the need for assessing pre-transformational organisational readiness.

If you are in the process of preparing to execute an Organisational Transformation, similar to this case study, then do consider working with me to either assess your Organisational Readiness or address issues that have come to your attention as result of this case study.